ESG Ratings measure ‘Environmental,’ ‘Social,’ and ‘Governance’ factors to help investors understand how well a company is managing risks in areas that are difficult to quantify by analyzing traditional financial metrics. However, unlike public company financial statements that adhere to standardized accounting and reporting standards, ESG ratings do not adhere to any global standard since no clear regulations exist yet as to what metrics public companies are required to report. This has resulted in highly subjective ratings across different providers, which rely, for the most part, on data that is voluntarily reported by companies of all sizes from across very diverse industries and countries of domicile. This has resulted in a series of very different data sets with significant inherent subjectivity in methodologies and wide variations in materiality from various global data providers.

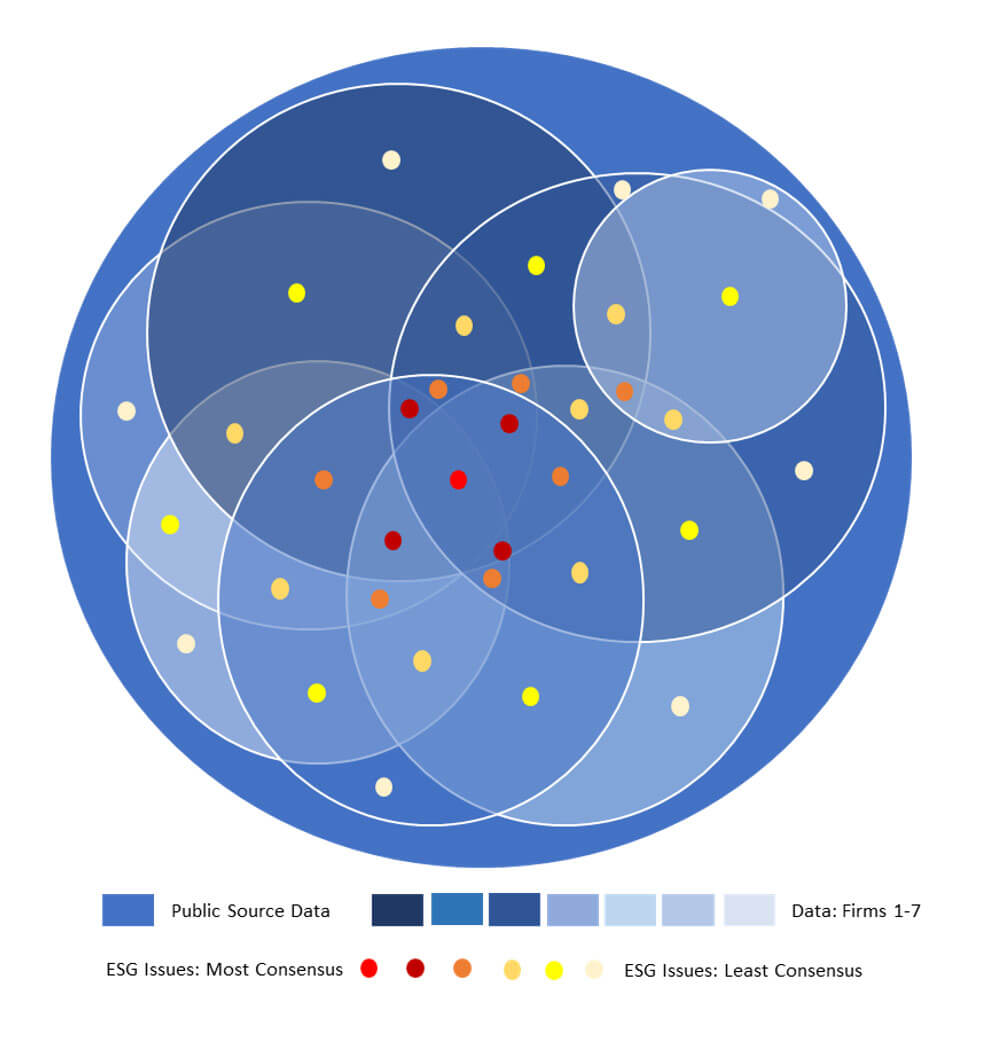

OWL Analytics, a California-based company that was founded in 2012, recognized the problems inherent in existing ESG ratings methodologies and decided to address them by pursuing a “wisdom of the crowds” approach using rigorous quantitative analysis. The company aggregates hundreds of sources of ESG information, including ratings from the world’s leading ESG organizations, and calculates ESG consensus scores from across all relevant sources for every company in its global database. OWL employs a “big data” approach to identify the ESG issues that each source deems most relevant for every industry and builds what it calls a “materiality map” that is different for every industry. This makes the company’s consensus ESG ratings unique, objective and highly relevant to each industry’s unique circumstances.

OWL aggregates hundreds of sources of ESG data, ratings, and research to create the largest foundation of ESG data in the world.

MarketGrader has partnered with OWL Analytics to develop ESG-focused indexes without deviating from our goal of helping investors achieve superior capital appreciation-oriented outcomes. Our partnership arose from the shared view that investors are better served by strategies that use objective, quantitative and rigorous analytics in identifying long-term growth compounders, while steering clear of subjective, ethical considerations expressed through an investment portfolio.

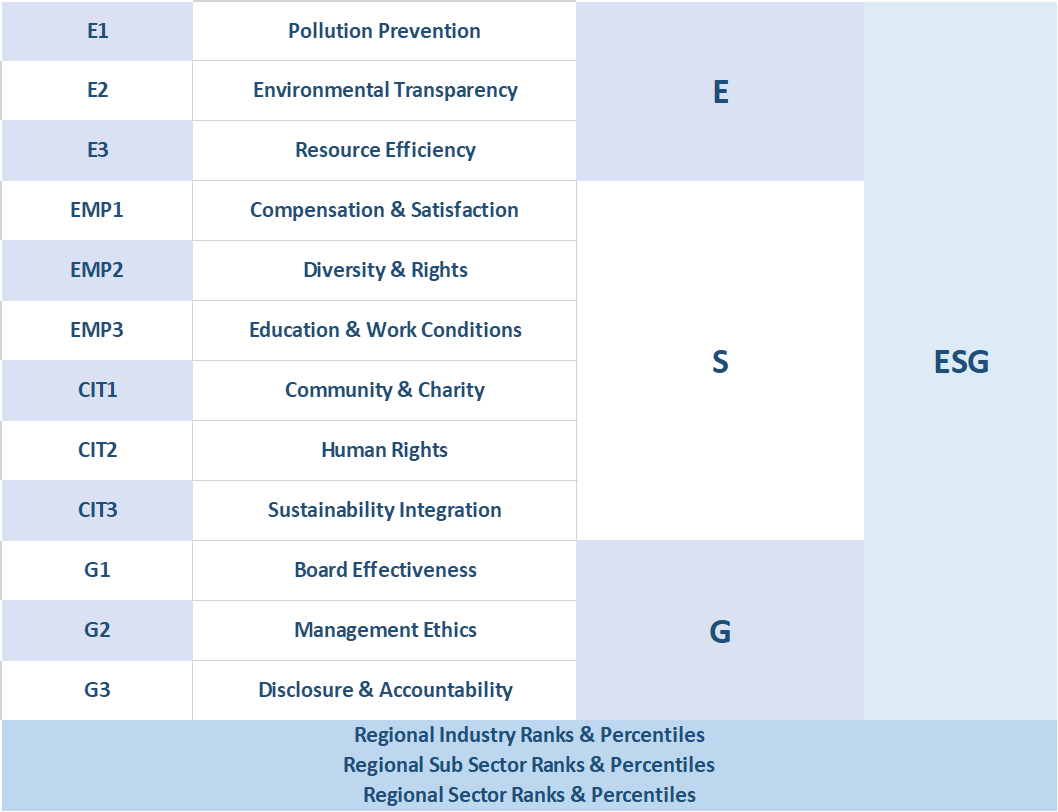

The Index consists of the 100 companies with the highest MarketGrader scores in the Consumer Discretionary, Consumer Staples, Health Care, and Technology sectors that are domiciled in China, one of the world’s fastest growing economies. In addition to satisfying MarketGrader’s rigorous GARP requirements, all Index constituents must be ranked in the top 50% within their regional peer group based on their ESG consensus rating as calculated by OWL Analytics (click here for the Index Rulebook). OWL scores and ranks all companies in its coverage universe across thirty core metrics, including 12 key performance indicators (KPIs), that quantify company behavior across Environmental, Social and Governance factors. A summary of OWL’s ESG Metrics appear in the table below, while complete description of OWL’s ESG rating methodology is available in the OWL ESG Methodology Guide.