Companies domiciled in the North America, excluding Canada, listed in U.S. exchanges

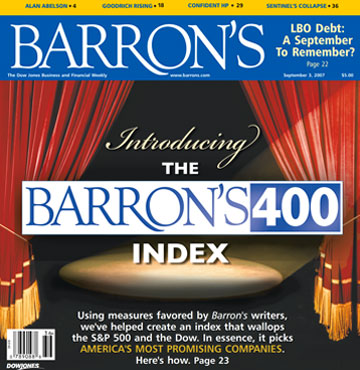

The Barron's 400 - An Index for All Seasons

The Barron's 400 ETF (NYSE Arca: BFOR)

2701 Ponce de Leon Boulevard, Suite 202

Coral Gables, Florida 33134 USA

Phone (786) 472-9017

Licensing@marketgrader.com